If you’re reading this, it probably means that you, or somebody close to you, is…

SMSF regulation details removed

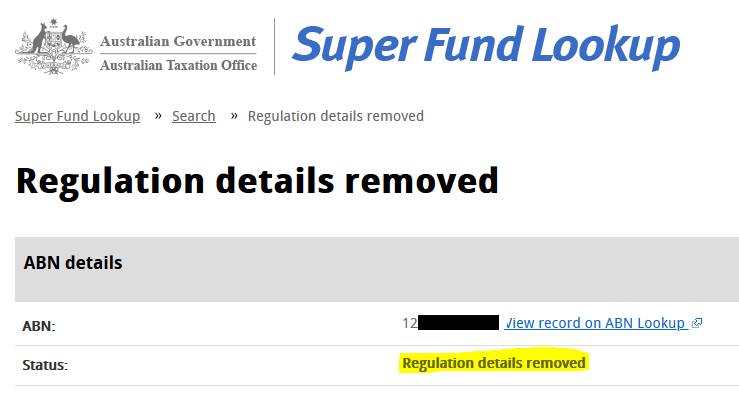

What does it mean if your SMSF status is Regulation details removed on Super Fund Lookup?

The explanation on Super Fund Lookup simply says: The regulation details of this SMSF have been removed from display in Super Fund Lookup due to their failure to lodge returns.

But you’ve already read that. Practically, here is what it means:

- You cannot roll money over from other super funds

- Employees may stop contributing to your fund

- Your bank may stop you from making withdrawals from the fund

- Applications for new accounts and investments may be rejected

There is no guarantee that all of these thing will occur – e.g. it could take months for your employer or bank to even notice the change of status.

But to cut a long story short: your SMSF is basically frozen.

How to I restore my SMSF to complying status?

There are two steps.

Firstly, your fund needs to lodge its SMSF returns for all the overdue years.

An ideal time to do this is before 31 October as this is the due date for your SMSF return (when you have a prior year late return). Remember, an audit of your SMSF is mandatory before you can lodge

Secondly, you need to wait for the ATO to update the register.

They do this in the first week of the month after the late returns are lodged so if you can have the fund returns lodged before the end of a month then you’ll be back off Santa’s naughty list a bit more quickly.

One of Beyond Accountancy’s specialties is late tax returns, including for SMSFs. It’s easier than you think. We have a detailed checklist of what you’ll need:

But don’t get overwhelmed. If you can provide the basic details for the fund and the bank statements that’s enough for us to get started. We can deal with the rest later.

We can deal with the ATO for you and work with any deadlines they’ve set. If you can’t make your deadline we can let them know that we’re working on it and indicate when we expect to finish.

My SMSF didn’t do anything the year I set it up. Do I still need to lodge and pay the $259 ATO levy?

Not necessarily.

The ATO has a process for newly registered funds that had no assets and didn’t accept rollovers or contributions. You can read about the process on the ATO website. We can help you with lodging this form via ATO Online Services for Agents.

In fact, you can have our pro-forma for free if you want to send it to the ATO yourself by mail (the postal address on the ATO webpage above).

SMSF Non lodgment request for newly registered funds

If you set up a fund and have changed your mind (without ever having any assets in the fund) you should contact the ATO to de-register fund.

What if you think your SMSF might have breached the rules?

If you think you’ve broken the rules then you might be reluctant to lodge your returns for fear of penalties.

The most common breaches would be taking money from the fund or using the fund assets for you or a family member (e.g. you bought a property with fund money then lived in it).

Whatever the breach is, you are much better off lodging, being honest with the auditor and trying to rectify the breach.

I’ve always said “if you want to get in serious trouble with the ATO you have to work hard to p@#% them off”. That is, serious fines and prosecution happen when you keep on ignoring them, and ignoring them.

A couple of late returns with a breach that you are rectifying may just get a warning letter from the ATO or a direction for trustee education.

Willfully not lodging over many years and doing nothing about the breach could lead to the trustees being fined and the fund being declared non-complying which can mean lots of nasty penalties you can read about on the ATO website.

To cut a long story short, deal with it now. You’ll be glad you did.

We’re here to help. Get in touch with us via our website or book an advice appointment using our online booking calendar.