Jarrod Rogers CPA, Feb 2022 The early retirement scheme (ERS) or early retirement plan (ERP)…

ATO misunderstanding almost costs worker a six figure tax bill

I want to quickly mention an issue that you might occur if you work for the Australian arm of an overseas company.

And I want to warn you that if you receive a particular ATO letter, you need to drop everything and sort it out. See below.

I had a client recently who worked for a well known multinational corporation. This company’s Australian workers were being paid from an overseas account, but under an Australian subsidary. The wages, tax and allowances were all (correctly) reported on MyGov as Australian wages, just like any other employer would. No issues there.

The problem was AUSTRAC.

If you haven’t heard of AUSTRAC, it’s the government agency that tracks movements of money from overseas. They track certain amounts coming into Australia (essentially large deposits or recurring deposits). This information is available to government agencie – including the ATO.

I can’t give you exact numbers as I don’t want to identify the person, so the details below are just an example.

Salary $150,000

Less tax: $ 25,000

Take home: $125,000

Employee shares vested: $100,000

Total taxable income: $250,000

Because the company paid payroll from overseas, the ATO sent a data matching letter saying my client my client had received AUD 125,000 from overseas.

And here’s the key misunderstanding. The ATO did not realise that the $125,000 was the salary. They thought it was in addition to the salary.

They wrote saying that, unless my client lodged their tax return within six weeks, they would assess them for $375,000 and not $250,000. Not only that, when the ATO lodge for you, this is called a default assessment. They have the right to charge a 75% penalty in addition to the tax you owe.

And the 75% applies to all tax payable – not just the mistaken income, but also the tax on the vested employee shares.

This was a perfect storm: foreign employer + receiving employee shares + AUSTRAC = huge fine.

So let’s add up the penalty in our example scenario:

1. Extra tax because ATO added the extra income: $125,000 x 47% = $58,750

2. Penalty on doubled-up income: $44,062

3. Penalty on vested employee shares: $35,250

Total tax due to ATO misunderstanding: $138,062

Luckily, we saw the letter, warned the client immediately, and lodged the return before the ATO deadline. The ATO followed up to ask us why we’d left out the foreign income and we cleared it up.

But here are the lessons:

- The ATO is tracking foreign transactions, and this can cause confusion if you have a foreign employer

- If you receive employee shares, you are likely to owe tax every time you do a tax return. Don’t get this mixed up with the fake tax the ATO wanted. That is, you might expect to owe tax due to the shares. But get your accountant to confirm it’s the right amout of tax.

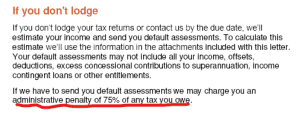

- I’ve taken a screenshot (with no private details) of and ATO default assessment warning. If you ever get a letter like this, or see the words “default assessment” anywhere in ATO correspondence, call an accountant immediately. One of my catch phrases for clients is “there is no such thing as a tax emergency”. This is as close as you can get to a tax emergency.

- Don’t assume that you can amend your tax return later and that everything will be fine. Yes, you can amend a tax return. And in the example above, that should have been enough to eliminate most of the tax. But the ATO could have legally left the $35,250 component in place, even after the amendment.

Note: if you’re late on tax, you’re at the highest risk. Perhaps you’re not ready to catch up yet. If so, as an absolute minimum, update your address with the ATO just in case they send a letter like this.

I hope this saves somebody from a large and unnecessary bill.