Jarrod Rogers CPA, 3 July 2020 No... you definitely can't. ...claim your coffee machine, that…

Tax Strategies before June 30

How to reduce your tax before June 30

Here are some simple strategies to gain a financial advantage before June 30. I’ve summarised these in a YouTube video.

- Make a personal super contribution

- Open a first home saver account

- Work out the tax implications of health insurance

- Pre-pay your tax deductible expenses

- Adjust your salary sacrifice for the new year

- Top up your spouse’s super

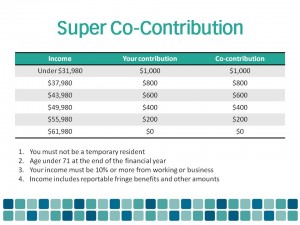

1. Super co-contributions

If you are a low or middle income earner the government may match your super contributions.

If your income is less than $32,000 the government will match up to $1,000 of your personal super contributions. If you earn between $32 and $62,000 you can get a partial co-contribution.

You only qualify if 10% of your money is business or employment income. So if you’re a stay-at-home parent or self funded retiree you won’t qualify. And be careful if you are salary sacrificing or receiving fringe benefits, as this limits your entitlement.

All you need to do is put the money into super before June 30. When you lodge your next tax return you will automatically get the co-contribution.

Contact your super fund for the B Pay details to allow a contribution to be made. You’ll need to allow 3 or more days for the payment to clear.

The co-contribution changes from July 2012, so that less people qualify and you only get 50 cents in the dollar. So 2012 is the last chance for many people.

For more information go to: http://www.ato.gov.au/content/42616.htm

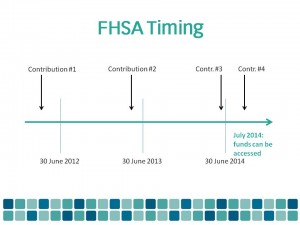

2. Start saving for a first home

If you are saving for a first home you should consider opening a first home saver account before June 30.

The first $5,500 of deposits into a first home saver account attract a 17% bonus from the government. It’s a great way of stretching your home deposit a bit further. The interest on the account is taxed at 15% which is less than half what most workers pay on normal bank interest.

The catch is that you have to use it for a first home, and you must contribute at least $1,000 to the account in 4 different financial years. This means now is the perfect time to make your opening contribution.

If you contribute $1,000 before 30 June you can withdraw the funds as early as July 2014. If you wait until after 30 June you can’t get the money until 2015.

It’s a great option if you’re currently renting and have a medium term timeline to buy your first home.

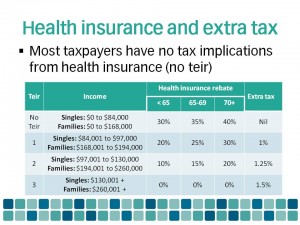

3. Health insurance

The health insurance ads are all over the media. The all pressure you to join before 30 June. But I think they are misleading.

Firstly, most people don’t pay the 1% medicare levy surcharge with or without health insurance. Singles need to earn $84,000 and couples $164,000 before the penalty kicks in. Plus, even if you’re liable for the tax, if you joint on June 28 will only avoid the tax for three days, but you’ll be penalised for the rest of the year. I have a separate video which covers this in more detail.

There is another issue that is not tax related, and that’s the lifetime loading. If you join insurance after turning 31 you have to pay 2% extra on your premiums for each year you wait. So you should think about the loading, as well as tax.

Finally, the 30% rebate for private health insurance is being cut out for higher income earners. So if you are in one of those brackets you should consider pre-paying your insurance before 30 June to get the rebate now.

4. Pre-pay expenses

If you have tax deductible expenses you should think about paying them before June 30. For example, accounting fees, income protection insurance and work-related expenses like membership renewals, and interest on investment loans.

If you want to pre-pay my fee for next year to get the deduction early then contact me and I’ll send you an invoice.

Pre-paying gives you a timing advantage by being able to claim the deduction sooner. It is effective if your tax bracket will be the same or lower next year. If you’ll be in a higher tax bracket next year, then you should NOT prepay expenses.

2012 tax rate higher than 2013: Better off pre-paying

2012 tax rate same as 2013:Timing advantage from pre-paying

2012 tax rate less than 2013: Better off NOT pre-paying

Common reasons for your income being lower next year are study leave, maternity leave and retirement. Also, if you have a big one off income such as a capital gain this year then you should consider pre-paying as many other expenses as possible before June 30.

5. Check your salary sacrifice limit

The limit on pre-tax, or concessional, super contributions will be $25,000 from 2013. This applies for over 50s and under 50s. Because most people’s super is paid in the month AFTER they earn it they the time to adjust your salary sacrifice amount is in June, not July. You should check with your employer whether your June super will be paid in June, or July. This makes a difference to your 2013 calculations.

It’s complicated, so I’ll give you a simple formula which you can use:

$25,000 MINUS Employer amount EQUALS Remaining limit.

Remaining limit DIVIDED BY Pay periods each year EQUALS Salary Sacrifice per pay

Example: employee has an income of $100,000 plus 9% super. Total limit $25,000 MINUS $9,000 employer contr. EQUALS $16,000 remaining cap.

$16,000 DIVIDED BY 26 pays / year = $600 / fortnight salary sacrifice. If the employee’s super is paid monthly in arrears they should start the $600 per fortnight from 1 JUNE not 1 July.

If need help working out the maximum salary sacrifice amount please let me know.

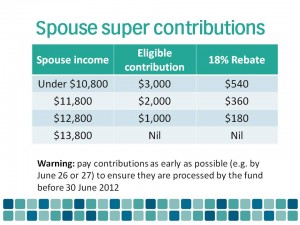

6. Other super contributions

And finally if your spouse earns $11,000 or less then you can make a contribution to super for them and get a tax rebate. It’s called a spouse contribution. Any amount you put in before June 30 attracts an 18% rebate. The maximum amount eligible for the rebate is $3,000 and the maximum rebate is $540.

If you are not sure about any of these tips feel free to contact me. For more helpful tips and videos you can subscribe for free to my newsletter.