Jarrod Rogers CPA, 3 July 2020 No... you definitely can't. ...claim your coffee machine, that…

ATO amnesty for back taxes or late returns

16 March 2020

In the past, the government has allowed concessions or an amnesty for back taxes, late tax returns and overdue debts. At the time of writing, there is a superannuation amnesty and concessions for bushfire victims.

You may be waiting for a tax, BAS or GST amnesty before dealing with your late tax returns. The failure to lodge (FTL) penalty is now over $1,000 per lodgment, so I can see how this would be a concern.

However, did you know that normal ATO policy could allow you to catch up on your late lodgments, completely without penalty?

And even if you are liable for fines or interest charges, there could be a valid reason for this, including illness, relationship breakdown, business failure or the death of a close family member. ATO policies allow for this.

ATO says “no tax bill, no late fine”

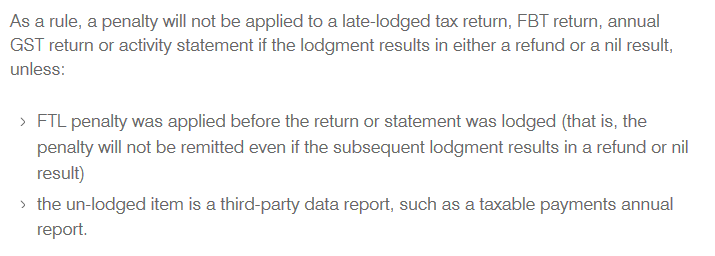

The ATO has a policy that might effectively give you an amnesty from fines, even though they don’t use the word amnesty.

The ATO won’t fine you if your late lodgment results in a refund or nil payable. That is, if you don’t owe them money, they don’t care if you’re late. The tax office is only concerned if you have their money, not the other way around, so the policy is: no tax bill, no late fine.

This is important if you’re one of the many employee taxpayers who have not lodged a return in years. In nearly all cases, the tax your boss has withheld from your pay will result in you getting a refund.

Since building a specialty in late tax returns, I’ve met many clients who’ve waited years to catch up on tax because they were stressed about the ATO late lodgement penalty.

Many of those were employee taxpayers who had stressed for nothing. The end result for them was simply that the ATO paid them some money. No fines, no penalties, no interest charges, no worries.

If this is your situation, it’s time to stop stressing and give us a call. With our online appointments, you could be anywhere in Australia, or even overseas, and we can help you catch up. Click here to read about how we can make the process super easy by chasing up a lot of your old paperwork.

Your “get out of jail free” card

Now you know that the ATO has a “no tax bill, no late fine” policy. But what if one or more of your late tax returns results in a tax bill? You might have had a lot of bank interest in one year, or owed money due to a capital gain, a HELP debt or a Medicare levy surcharge.

You can still avoid penalties if the ATO chooses to issue you a warning instead of a fine. This is a regular practice. In fact, getting a warning instead of an ATO late lodgement penalty or fine is so common that I tell clients they have a “get out of jail free” card.

The taxpayer will get a warning letter and no ATO late lodgement penalty or fine. If they are late and payable in the future, there is a high chance of a fine. But if the returns are lodged in the right order the catch-up returns will result in no fine.

Let’s use a real-life example. Jim (not his real name) was an employee taxpayer who hadn’t lodged since 1998. He had refunds in most years, but not all years. By lodging the returns in the optimal order, Jim ended up without any fines, received a net refund, and the worst he got was the generic warning letter below:

Interest charges and reversing ATO fines

Late fines are only half the story. If you’re late and you have an overall tax debt, you also need to face a general interest charge or GIC.

The GIC is there to discourage people from using the ATO like a bank, and making the outcome worse for late payers compared to those who are up to date.

If you are seven years late, the GIC will effectively double your debt. This can turn the debt from “do-able”… to impossible.

The ATO has policies and procedures for ATO GIC remission. Firstly, you need to look at your ATO statement and separate the original tax or GST bill (what the ATO calls primary tax) from the total debt. You can avoid a primary tax bill under very limited circumstances, but most of the time you will need to pay this.

The remaining debt – the penalties and interest – can be negotiated. If you have been affected by death, illness (including a family member’s illness) or natural disaster the ATO will factor this in.

You need to make sure your request is in line with their policies, and that you can show the link between the hardship and the late returns.

It can be a matter of “lucky dip” with the ATO. Some of their staff are helpful and compassionate, and if they see you are genuinely keen to clear the primary debt they will be lenient on the penalties. Some of them not so much.

So while there are no guarantees of remission of penalties and interest, it’s definitely worth having somebody with experience in the system make the application for remission. We know what the policies are and can advise whether your situation fits in the guidelines for remission.

We are here to help

Whatever your situation, we’ve probably seen it before. We have been late tax specialists for 9 years now. In that time we’ve lodged hundreds of late returns, as far back as the 1991 tax year.

We’ve had combined penalty remissions of at least half a million dollars, including over $100,000 at a time where family hardship was the cause of late lodgments.

We pride ourselves on being non-judgmental. Most of our clients find out that their situation is nowhere near as bad as they’ve been worrying about.

If you’re ready to stop stressing and start taking action, book an appointment. It’s not always easy and the first step is the hardest. But, from experience, finding out is better than the anxiety of not knowing.

We have an online appointment option, so wherever you are in Australia (or overseas) we are available. You can get in touch via the contact us or the book now link on this website.